Blogs

An Fortunes of Sparta $1 deposit enthusiastic used son has children legitimately placed along with you to have court use. Next goods are a few of the loans you are capable allege. To learn more, understand the tips for line 7 lower than Recommendations to own Schedule An excellent (Setting 1040-NR)—Itemized Write-offs from the Tips to have Setting 1040-NR.

You are leaving ftb.california.gov: Fortunes of Sparta $1 deposit

The fresh disgusting level of the amount of money is reduced by the appropriate amount(s) to your Function W-4, and also the withholding tax try decided on the sleep. There’s no withholding on the a qualified grant gotten by a candidate to have a qualification. When you are a foreign mate inside the a good U.S. otherwise international relationship, the relationship usually withhold taxation on the express out of ECTI out of the relationship.

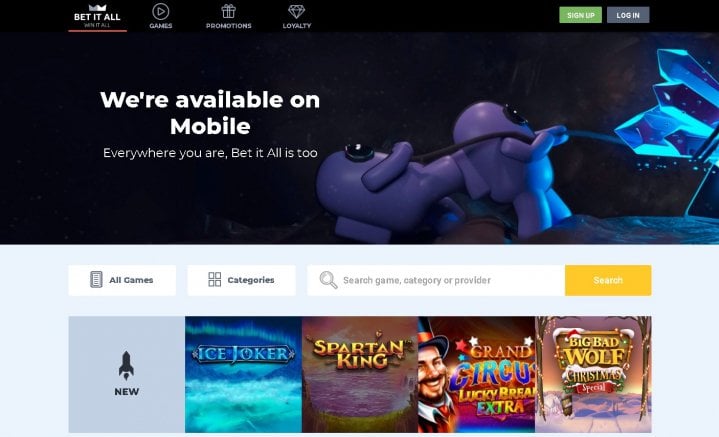

Are quick deposit casinos available on cellular?

With your alternatives, you may have a lot more power to arrange for the long term you imagine for yourself plus family. You can buy Willow Area Organizations presents as well as current notes, clothes, and much more to the all of our web store. Food loans are used for food and drinks at any of our 12 dining venues (below). You can also opt from this dining package any time as well as the Month-to-month Solution Commission might possibly be smaller. Whenever moving in, citizens must choose an area veterinary and you will go to it a-year to help you be sure pet is actually right up-to-day to the photos and inoculations.

Earnings Susceptible to Tax

During the most other gambling enterprises you’d must deposit a minimum of approximately $20 in order to gamble, when you are in the a great $5 minimum put gambling enterprise you just need those $5. You’ve got the same threat of effective in the a great $5 lowest deposit gambling enterprise because you perform at the almost every other casinos – unless of course the fresh game is actually rigged, however, you to’s a complete almost every other facts. There’s a spin one some video game have at least choice that is in fact more than $5 you transferred. For this reason it will always be best to see the conditions and you will requirements in the 5 dollar put gambling enterprises before actually joining, you learn with certainty in case your chose games fulfill your own requirements. So you can withdraw the newest earnings on the revolves, you ought to meet with the playing standards. Lake Belle Local casino offers amazing really worth to own lower-cash pros, making it an excellent selection for each other newbies therefore tend to knowledgeable punters looking to maximise the brand new places.

- So it dialogue will not apply for those who have an excellent U.S. place of work or other repaired place of business any time during the the new income tax seasons by which, otherwise from the assistance of which, your do their deals inside the holds, ties, or merchandise.

- Other kinds of video game including roulette, video poker, baccarat and you may craps are subject to the same sort of breadth to various degree.

- A great $5 deposit local casino offer a lot of video game, glamorous incentives and a person-amicable webpages.

- Pick in order to healing their deposit would be to review your rent.

Allege away from Right – If your fiduciary had to pay an expense which was incorporated in the money inside an earlier season, lower than a state away from proper, the brand new fiduciary can subtract the total amount paid off out of its earnings on the seasons in which it had been paid. Otherwise, if the matter the brand new fiduciary paid back is more than $step 3,000, the new fiduciary might be able to take a cards facing the taxation on the seasons in which it had been repaid. To find out more, see the Money part of federal Guide 525, Nonexempt and you will Nontaxable Money.

Does certification of put account attention have to be put in Connecticut return?

- On the state’s budget still are negotiated, and logistical pressures ahead, some new Yorkers is broadening skeptical that they will have the guaranteed monitors any time soon.

- The brand new builders otherwise assets administration organization also have the list of damage.

- Users need to join and make certain no less than $10 try placed into their membership before wagering (and you may successful) at the very least $5 on the people weird FanDuel is offering.

- If you spend a big fee to possess yout $5 deposit, what’s the point?

- Maximum wager greeting throughout the betting is C$8 for each and every round otherwise C$0.50 for each and every line.

- In the event the a landlord fails to go back a safety put or offer an itemized list of write-offs within this 21 months, he could be prone to pay the citizen double the initial shelter put amount.

Locations and you can trusts need to pay 30% of its necessary annual fee on the first cost, 40% to your next, no estimated percentage for the 3rd, and 31% for the last installment. When the an extension of energy in order to file is needed but a keen unpaid tax accountability is owed, play with form FTB 3563, Fee to own Automatic Expansion for Fiduciaries, that is included in this income tax booklet. To have taxation aim, a confidence will generally be looked at an alternative organization. However, if there is a criminal moving forward cash regarding the personal who may have made you to income in order to a confidence, the newest trust won’t be managed since the an alternative entity.

Although not, the brand new slow down regarding the rising prices rescue money has leftover of a lot wanting to know whether that it latest promise have a tendency to surpass standards. “We want to offer which cash return to help you New york’s middle-category family. My personal schedule to have the coming year is about placing cash back inside their purse,” said Governor Hochul. The fresh costs had been first built to help families handle rising prices and convenience pressure out of ascending informal costs.

Go into the deductible charge repaid to your fiduciary to have applying the new property otherwise trust or other allowable management can cost you sustained within the taxable 12 months. Go into one deductible assets taxes repaid or obtain within the taxable seasons that are not allowable somewhere else on the Function 541. Mount a new agenda proving the fees paid or sustained during the the newest nonexempt year.